Community Currencies

Next: Protection against Inflation

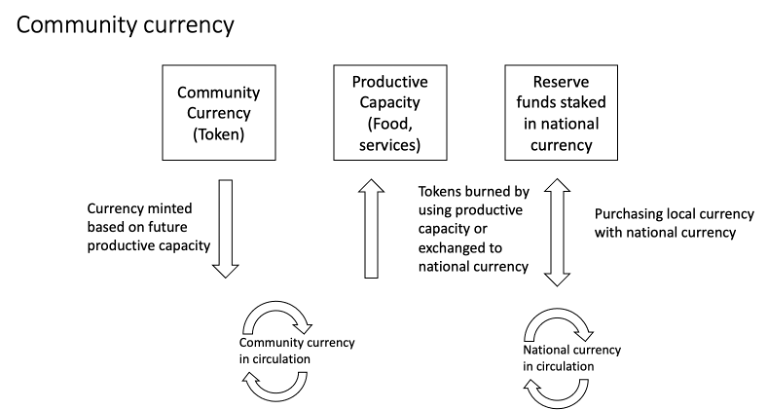

TL;DR Community currencies are money that circulates only locally. It needs to be pegged to some productive capacity or national currency to give it validity.

Let’s go through different ways to implement local currencies starting how they’ve been done in the past before the introduction of community crypto-currencies (C3s).

Examples of Community Currencies (pegged to fiat)

Region or city can introduce its own currency that is valid within its borders. One well known example is Bristol Pound that is now in transition period to Bristol Pay. Idea is that the local currency is valid within city boundaries but not elsewhere. The city accepts taxes and other rates in this currency. It can also be used to buy produce such as groceries and to pay for services such as repairs and haircuts at accepting businesses. Local municipality issues the currency and itself uses it to pay when it buys something from local businesses (that are part of the system).

For this regional currency to have validity, it needs to have some backing – to be pegged to an asset. The simplest is for the city to have a certain deposit in national currency on a bank and create corresponding amount of local currency. For example, Bristol Pound was convertible at 1:1 to Pound Sterling at several cash points around the city.

Another such a scheme was the Austrian city of Wörgl where after the first world war the mayor noticed that the city had plenty of resources and plenty of workforce and lots of needs but all the money generated had to be paid to service debts. The good mayor Unterguggenberger and city instituted own currency called also Wörgl pegged against what the city had in bank as reserve in national currency. Workers were paid in Wörgl for working to rebuild schools, roads and it was valid for paying local municipal taxes.

Wörgl also had inbuilt 1% monthly loss of value to ensure that people to paid their municipal taxes early in Wörgl so that city got income as fast as possible to invest again into rebuilding.

That’s how they got local economy kick-started and get the rebuilding going until later the scheme was deemed illegal by national authorities. (source: Douglas Rushkoff: Throwing rocks at the Google bus)

Community Currency (Pegged to Local Products or Services)

A local currency can be started also without any fiat currency, just backed by some local productive capacity that is generally needed by everyone. Let’s take as an example an association or cooperative producing for example foods of some kind. They can issue a voucher/promissory note against their future produce and pay their suppliers and employees part or all with this currency. The peg is good to keep 1:1 against local fiat to keep it simple. This allows people to use either currency interchangeably according to what they happen to have.

This currency can risk free accepted by entrepreneurs in the community as they know that they can always buy essential goods with it. Employees who have got the community currency can buy for example fish, the fisher can use it to pay for their children’s school and the teachers can use it in the barber and barber change it to food ultimately. It starts flowing in the economy and de facto acts as local money.

To help the currency circulate and stimulate the local economy, the issuer may decide to go for staged buy-back. Otherwise, there is a possibility that people immediately change the voucher back to whatever product or service the issuers offer and currency does not act as a stimulant for local trade. Or it may be redeemable only when crops ripen.

This community currency can additionally be backed by additional reserve made by national currency. This works so that anyone with fiat can buy the community currency. When there is this fiat-based reserve, people with community currency can exchange it and get fiat that they can use to buy non-local products.

When using community currency, it is equivalent to fiat currency. But the sale of community currency against national currency does not have to been 1:1, but dynamic. This means that if there is very little fiat in the reserve, you get more community currency and this gives strong incentive to buy into it. When the reserve is full, the price goes down again and people stop buying it.

This is how for example community currencies in Kenya like Bangla-Pesa work.

(Source for image: Will Ruddick on Youtube)

Its possible to also develop mechanisms for exhanging between the community currencies of different communities. Decentralised exchanges on the web3 world have developed mechanisms how to automatically exchange between different tokens. The original protocol is called Bancor and there are different versions of it. These algorithms or their variants can be applied also to community currencies.