How money works?

Next: Eurozone

As last vertical or domain, before starting to integrate topics together, it is good to see how money actually works and what digitalisation can mean to it.

Money creation in banks

http://positivemoney.org/wp-content/uploads/2012/03/How-Banks-Create-Money.pdf

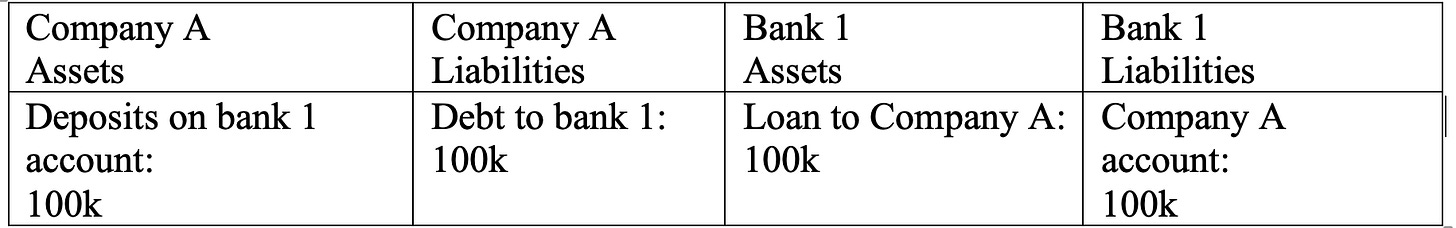

Banks create money with a fairly simple mechanism. If a company -say a factory - needs a loan (here we assume 100k) they ask for a loan from the bank. Bank has regulatory requirements to check that the loaner can repay and as guarantee they ask for collateral. When everything checks fine, they simply create the amount in their books and hand the money over to you against your collateral. You now have the loan amount and bank has the collateral.

In the bank the loan is recorded on the asset side in bookkeeping and money is deposited on the company’s account on the liabilities side.

In the books of the company (Company A) the deposit is written to the assets side and the debt to liabilities

And as image:

Same money creation happens when a bank buys governmental bonds. In this case government gets the money.

Payments within a bank are also equally easy. Let’s say company A wants to buy something from supplier Z who has account on same bank. The required amount from company A would simply be moved to the account of supplier Z (100 k below). (The table below does not show how the sold items get recorded in accounting).

Payments between banks

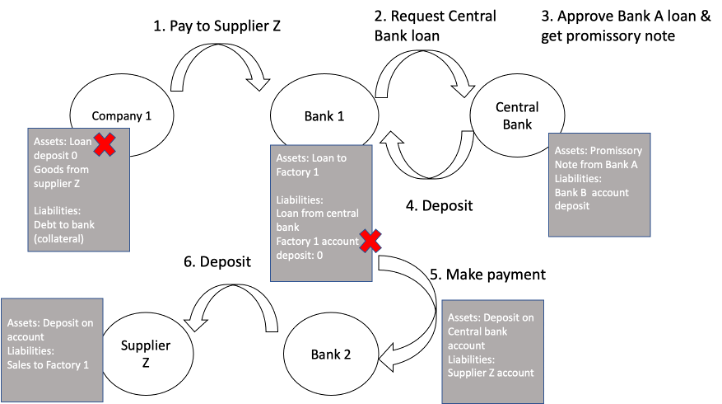

If supplier Z is in a different bank, the scenario is a little bit different because payments between banks are done with central bank money.

All banks have an account at the central bank (known as reserve account). Money in these accounts is called central bank reserves. To make the payment, bank 1 needs to loan money from the central bank. Central bank creates money in similar manner to the how other banks do – by making entries in its books. The payment between two banks that have account at the central bank is same as when two customers that have account on the same bank. For the central bank a liability to one bank becomes a liability to another bank in their books.

And as image

Now bank 2 has the sum of 100k on the central bank account, and they can loan it further. But not all of it. Often there is a need to keep a fraction - today usually1-2% - of the deposits in cash or other liquid form. This is one way how money multiplies in economy.

Banks can make loans even if they would not fulfil the fractional reserve, because they can loan money from the central bank after having made the loan approval. In practice central banks always grant the money. Alternatively, banks can loan central bank money from other banks if the rate is lower than the interest of the central bank.

Thus, lending from banks depends only on how much there is good property to use as collateral, how much there are good investment targets and how much risks companies and households are willing to take. The term used is that money creation is endogenous (created within itself).

When debts get repaid, the process is reversed, the created book keeping entries erased and created money gets destroyed.

Central bank asks for interest of the loans that it has issued to banks just like banks demand interest from their customers. Also, if banks have more money than they can lend at some time, they can deposit it at their account in the central bank and the central bank pays interest for it.

Loaning from Your Future Self

As seen in above loans need collateral – some real property to use as a backup to cover losses if the debtor cannot pay. Banks want and have legal requirement to do this as it reduces risks. Part of the collateral can be the property being purchased with the loan but such property cannot be the whole collateral as property values go down from time to time. Some buffer is required. If loaner does not have enough property someone else can promise to be their backup (surety).

Debts speed up the economy because they allow to invest earlier. Without loans one would have to first save up the whole sum and then make the investment. Since prices tend to rise (often central banks try to ensure there is roughly a 2% inflation rate), the investment shifts even further during the saving period. When one has surety or collateral, it becomes possible to invest into new property fast and pay back the loan and interest with the income from it. One way of looking at it, is that you loan from your future self when you take a loan.

Controlling Flow of Money in the Markets

The interest that loaners need to pay naturally restricts the amount of demand. And this is influenced heavily by the interest that banks have to pay for the money they get from the central bank. This is called discount rate. They can only loan so far as they find customers that accept rates that cover the central bank rate, general economy and consumer risks and banks own profit margin. Banks also loan to each other. The rate they charge each other is called interbank rate.

At any time, banks need to keep certain number of liquid reserves as mentioned above. There is a commonly held belief that this restricts their loaning capacity. Strictly speaking this is not so. First the reserve requirement is very low. In Finland the Reserve Requirement Ratio is 1.0 % in Mar 2021. Secondly banks can meet this requirement after the fact. When you get a bank loan for an apartment, no one calls or checks from their central computer if our bank has enough reserves. The limit is based on market demand, companies and individuals ability to pay back and good quality collateral. The central bank discount rate raises the rate consumers need to pay and this limits their loaning willingness. Banks are happy to loan at any rate as long as they feel customer can pay back and have collateral.

Central banks set the discount rate and the interbank rate cannot raise higher than this because the loaning bank could get a loan from central bank cheaper. Central bank can also control the lower bound by paying interest if banks make deposits to central bank. This way the interbank rate sets somewhere in between. Say if discount rate is 2% and European Central Bank interest for deposits is 1%, then Euribor (interbank rate in euro region) would be somewhere around 1.5%. Euribor is commonly used as baseline in defining the interest consumers pay in the eurozone.

Another way central bank can control the amount of money circulation is through so called open market operations. Open market operations affect how much there is demand for corporate bonds. Corporate bonds in turn are used to invest into economy. By controlling this demand Central Banks can try to affect rate of economic activity.

In open market operations Central Bank buys typically government bonds (also foreign currencies, gold etc.) and the interest of these go down because there is larger demand. Then other investors switch to buying corporate bonds for higher yields and due to more demand the interest of corporate bonds go down. Companies get cheaper money which they then invest into economy. Economy heats up and grows. And when central bank reduces open market operations, interests of corporate bonds go up as there is less money in the market. Economy cools down.

The central bank buys the government bonds indirectly. First private banks purchase them and then the central bank buys from private banks. Banks make a profit in the process. But end result is same as if the purchase had been direct.

Central bank can in exceptional circumstances also buy directly bonds from private businesses such as pension funds, insurance companies, private banks etc. Money is transferred to the bond issues account increasing their liquidity.

Quantitate easing (QE) is a process of helping economy with these open market operations. In QE the government creates the demand for money by issuing bonds when other demand for money has totally dried up. This injects new money to the economy. QE is the way how banks were saved in the financial crisis of 2008 by getting very large sums of central bank money as result of it. Government then does infrastructure and other investments injecting bond money to the economy. As central bank does majority of government bond buying, private banks then need to find other loaners from the private sector. This increases supply of money and speeds up the economy. That’s the theory. If there is lack of good investment targets it may end up just driving up property, share, and gold prices.

Third way central banks control the economy is through so called Open Mouth Operations. Speculative statements about the intentions of the central bank. As an example, when in June 2012 there were fears of the breakup of the eurozone, ECB president Draghi said:

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

This and a following program to build government bonds did calm the market even when actual bond purchases only started in March 2015.

Why controlling interest rate is so important?

The key role for money is to be a stable store of value and help households and companies make economic decisions. In particular the price of everyday products and services should be relatively stable over a reasonable time. Big swings are especially disruptive to households and small businesses. Large corporations can hedge their costs with complex contracts and financial securities and wealthy individuals can hire professional help to manage their assets.

Price stability is a public good contributing to efficiency in the markets and prosperity.

Economic Cycles

Economies tend to have a cyclical nature oscillating between booms and busts.

A new cycle starts after a recession with majority of borrowers using a conservative approach. People tend to make decisions based on what they know or perceive to know about the future: what they expect to earn if they make an investment, what the government is likely to do (if they follow politics) and in general rules of thumb, instincts and what other people like friends and relatives are doing. After a bust everyone is cautious. Most are what is called a “hedge” borrower – little but seldom.

The good times start rolling after a recession and both lenders and borrowers begin getting more carefree, because they have seen others succeed in speculative or risky investments. Investments switch to less safe targets and people base their calculations more on how the price of the asset they buy with loans is expected to rise rather than direct return of investment. These are called ‘Ponzi’ borrowers. Debts soar until it becomes obvious that they cannot be repaid.

Banks tighten their principles and there is less loan available. This leads to asset prices going down and banks to start asking for additional collateral to cover their regulatory requirements. Loaners do not always have it and increasing number of borrowers start to default. People who have defaulted, do not consume and overall demand for products and services starts declining. Everyone gets more cautious and wants to pay back loans fast instead of spending. Even healthy companies start showing losses as demand rapidly falls. Losses make it more expensive and harder to loan further and this in turn creates more losses. This creates a snowball effect.

In theory during downturn prices and wages should adjust when demand decreases, but in practice this happens with a delay because there are oligopolies and monopolies (also public monopolies like municipal utilities) and people strongly reject reducing wages.

The economy goes into recession. This happens regularly every ten years or so in the economy.

Central banks can lower interest rates to stimulate growth but at some time the rates reach zero. Even negative rates have been tried in recent years. Negative rates do have their risks. For example, banks have assets like mortgages that are tied to interest rate and negative rates can squeeze the profit so low that banks are no longer willing to lend out money.

The situation when prices go down is called deflation. During deflation it makes sense to delay all purchases as long as possible, because the price is likely to be lower next week and even lower next month. This further shrinks the demand.

At some point lenders will agree to cut the debts partial payment or to get paid over a longer period. This is called debt restructuring. It is better to get something rather than nothing. This again causes incomes and property values to go down.

Unemployment is up and people need financial support from the government. To stop this vicious circle governments create stimulus plans and increase their spending to make up for the decrease in the economy. This is called a counter-cyclical move. Typically, governments either increase the taxes on wealthy, borrow from private sources or through quantitate easing (QE is a form of taxation; the newly created money is given to government thus increasing amount of money in economy and this in turn lowers the purchasing power of money through inflation).

If the recession lasts long, this easily leads to social unrest. Wealthy try to move their income away from increasing taxation. Less affluent feel the rich are not participating enough.

In a boom economy when economy goes up, the policies follow positive sum games. Everyone gets more and the focus is in growing the economy even more and inventing new helpful policies. When the cake stops growing and then starts shrinking politics switches to zero sum game. Everyone tries to assure that their part of the cake is not reduced using all kinds of populistic arguments. Thinking switches from problem solving to finding reasons to blame each other and justifications for protecting own part of the shrinking pie.

Governments need to balance the stimulus spending. If there is too much money spent, people start expecting high inflation rates and to retain their living standards, start demanding higher salaries immediately. The end result in this case is high inflation with no improvement in employment. End result is constantly raising prices with high unemployment. This phase is called stagflation. To combat high inflation, central banks would have to raise interests but this in turn increases the costs of loans for people and enterprises again slowing down the economy.

When governments inject money into economy to keep it afloat, sometimes purchasing directly corporate bonds, this keeps all companies afloat. Also to uncompetitive companies producing products and services that are not needed (as better alternatives have emerged). Increasing number of people go to work producing goods and services that do not have demand because money is flowing in from the central bank. This is called zombification of the economy.

The central bank needs to follow closely the economy as they create new money. The role of central bank is to offset the falling demand of credit in markets to create price stability in a way that allows government to support employment. If the balance is right, growth will be slow but debt burden goes down.

If countries ever go to such a bad state that they cannot recover from it on their own, the IMF was originally formed to be the lender of last resort. In return they put strict requirements on countries – deregulation like stopping subsidies, price and currency controls for example and fiscal control (do not spend too much by loaning). The strict rules from an external agency work well because it allows domestic politicians who have ruined the economy to put the blame on an external actor (“it’s not us, but those horrible hawks from IMF who demand this”).

This method is called either the Washington Consensus or sometime shock therapy. This has worked several times in the past like in Germany after the WWII and in Poland 1990 but did not work in Russia where deregulation led to massive corruption and former leadership taking ownership of previously state-owned enterprises.

In a complex, chaotic system like the economy, every case is different. Any single theory tends to be wrong when applied stubbornly.

(main source: Ray Dalio: How the economic machine works)

Path to fiat currencies

That’s it for a short story how money works. To wrap up, a little on the history of money.

The first standardised units of value were agricultural produce like barley. Many other goods have through history since then also acted as money, for example tea, tobacco, salt. Money, whose value comes from the commodity what it is made of, is called - unsurprisingly - commodity money.

Fairly early precious metals replaced these if they were available. Both gold and silver and the value of the coin was based on its weight.

The figure on the coin – emperor, king or queen – signed the quality control aspects. That is the person responsible for ensuring that it really contained the valid amount of set metal. Many names for money are actually weights. Pound is a pound of troy-silver (about 373 grams), mark is half a pound and comes from the mark used to cut a bar of silver.

For a coin to be valid, its weight had to fall within certain limits. First mints were not quite accurate sometimes creating coins with too much material. This created the first gaming opportunity as it was possible for mint employees to cut small slice out of the coin so that the result was still within tolerance limits. This was typically an offence that carried death penalty but rewards so big that many risked it. The rim and ticks around on coins are the first security feature implemented to prevent cutting metal out of coins.

Inflation was introduced in the form that rulers tended to lower the precious metal contents by introducing cheaper metals into the coins. This allowed the ruler to mint more coins from the same amount of silver or gold. This process is called debasement. Since there is limited number of gold and silver, coins began to made from other metals as well, bronze being a common alternative.

https://en.wikipedia.org/wiki/Roman_currency

https://en.wikipedia.org/wiki/Orichalcum

Later when paper notes were introduced, their value was based on real gold stored in the vaults of the banks until the link was broken in 70s and we ended up with more or less the current system. Strictly speaking lots of financial products have been brought to markets since then, but we do not cover these on this substack.

Both breaking the linkage to gold and debasement (less gold and silver in coins) are different solutions to the same problem. There is only a limited amount of precious metals to use for coinage. Gold, silver have other uses in jewellery and nowadays also industrial uses. At some point the economy of a country is too big for the gold reserves to use for money and the supply of money starts limiting economic activity. The other reason naturally being that debasement (printing more money) allows rules to spend it on topics important to them. At the same time debasement makes everyone else poorer as the value of money sinks.

Next: Eurozone