Decentralised Model in Detail - Money, Tokens and Financial Flows

Next: Defence

Money today

To think of how money (aka motivation) in future will work, it’s good to understand how the monetary system works today. This is gone through in the post series starting here

Some of my surprises about money are below

Its commonly believed that banks loan money that people deposit on their savings accounts and like. That’s not how the system works. Banks role is to estimate how likely a customer is to pay back the loan (following national regulations) and as long as there are eligible customers (collateral etc.), banks will issue loans. The fancy way to say this is that the money creation is “endogenic”.

Its also commonly told reserves that banks need to hold limit their ability to loan. 10% is often quoted as requirement. The real value is 1% for example in Finland (called reserve requirement). Companies that get loans then purchase various things from other parties and the money end up distributed to other banks. These banks now have deposits that increase their reserves allowing to issue more loans. That’s how in practice the limits on loaning are not very strict to say the least.

The origin narrative for money is that it was invented because barter (changing goods to other goods) is so cumbersome. A competing story that I like is that rulers needed a convenient way to fund their armies as taking resources by force caused resentment. When rules made people pay taxes in with some standards value unit, it allowed them to fund army with it. Army could then purchase goods with it, and now people had money to pay taxes forming a closed loop. There is a small step for using the same unit trading between private parties. Originally this was some physical good like standard measure of barley but fairly soon precious metals were used as they are more convenient to carry around, then replaced by bank notes and now just numbers hold in database at a computer.

The topic of money is handled quite a lot, starting with “How money works” and then followed with many others. We won’t repeat those contents here as they simply describe existing world order.

Tokens in Web3

Tokens are the measurement unit of the blockchain world. A token can represent anything, its just a record keeping mechanism indicating that this account has this amount of tokens or this specific token for non-fungible ones. What it represents is programmed somewhere else. That’s why sometimes people speak of tokens as programmable money even though value bearing tokens are just one subcategory.

Token are used to motivate people to join projects and are given as financial or prestige rewards for work they’ve done. Web3 projects are all opt-in. People join because they either believe in the stated aim of the project and/or are looking for additional earning opportunities.

Two common uses for tokens are as a way for pay for the services that the project provides and as a way for having voting rights.

In a world with a multitude of project specific tokens, decentralized exchanges handle changing between them.

We’ve envisioned a world where pretty much everything can be decentralised and could operate on token based rewards. This would be creating digital designs, software, AI-models, training others, sharing tips and troubleshooting on online communities, generating and selling energy, producing physical products with their assets (3D printers, flow chemistry labs), running vertical farms or providing services like fixing things.

Some of these jobs will be taken over by robots over time as automated manufacturing becomes more common.

If people do not want to make anything, they still have passive earning possibilities. This could mean sharing assets like computing capacity, storage or selling your own data. In the crypto world there are already quite a few projects where one can sell weather related measurements, own browsing data, data from own car, network quality data, noise data and so on. The most valuable information would be health data but it is extremely sensitive. We covered this with alternatives to protect privacy in health.

Additionally people can invest their tokens into projects or physical infrastructure like energy generation and get income through that. And on top there are other models like being a patron to an artist.

The question naturally arises why projects just don’t use regular, national currency? Benefits of tokens come from the fact that each project can program own rules for tokens and experiment with several token types: one for using the service (utility token) and another for collective decision making (governance token for voting). Projects can test with different reward mechanisms and ways to steer decisions ranging from crowdsourcing ideas with participant voting to delegating decision power to permanent committees (like mini-departments in a company for marketing, r&d …). And last but not least, tokens are global, anyone from anywhere can join.

National currency does not allow for such flexibility and innovation.

For more on token ecosystem design.

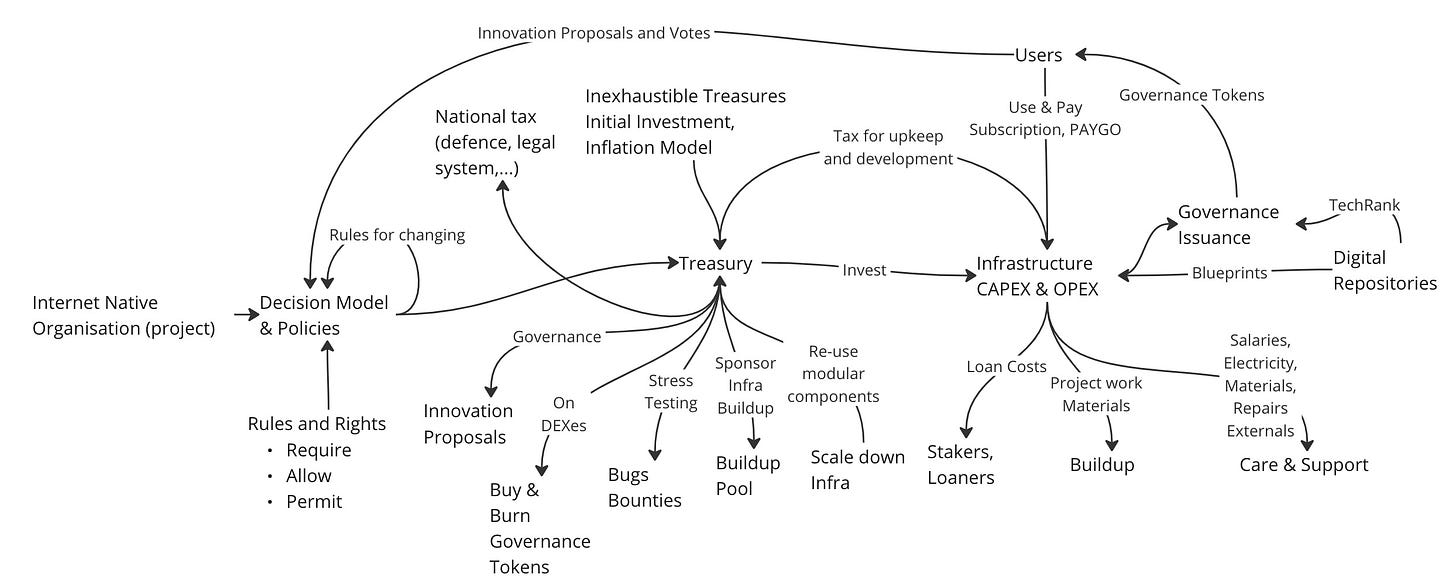

Financial flows

For the projects to work, the rules guiding rewarding and token issuance need to be well set so that participants get fairly rewarded irrespective when they join the project and that generating too many tokens does not lead to “hyperinflation” bringing the value of a specific token to the floor. There are specific guidelines for designing tokens that typically start by listing stakeholders and what are the desired and undesired actions in the token system. Take a look at for example outlier ventures model references above. And tools like cadcad can used to simulate token systems before they get implemented and published to the unsuspecting public.

For more take a look at token engineering academy

But let’s take a huge step sideways, omit simulations and take a small peek-a-boo at a few draft designs how financial flows might work.

We’ll see that they digital, physical and public services may end in different designs.

Digital services

Let’s start with purely digital service (SaaS like computing, storage, or some specific service)

The core flow of value goes like this:

Users pay with stable tokens or a project token to the service. The payment can be per item or a monthly subscription. Service can be a single service or a large repository of content for example.

Tokens are stored in software called wallets (hardware wallets, phone app wallets or centralised wallets). People have different tokens in wallet and when they need a specific token for payment, wallet software automatically handles exchanging (unless they already have it). Exchanges happen at decentralised exchanges, who take a small fee for the transaction, but it is not big as everything is automated

Tokens are used to pay for the services = sent to a smart contract that handles settlement

The assets and services in the digital repositories are crowdsourced. The users create and contribute but also consume (called prosumers).

The settlement contract allocates most of the income to the people who are providing the service.

As there are transaction fees for each and every transaction on blockchains, it makes sense for the settlement contract to keep balance for each user (technically wallet address) that is providing services and each user decides independently when they want to take out accrued rewards (i.e. make sure that after the transaction fees being carrier out, you get a nice amount). Modern blockchains are starting to emerge with very low transaction fees.

As the asset is often are the result of work of multiple people, a well understood reward division mechanism is needed. Division can be an agreement between creators or based on a common algorithmic approach (a variant of page rank like TechRank/ContentRank). This bit it today absent in current web3 projects.

Rest of payment goes to project treasury

Treasury is used to pay for Bugs Bounties (fault finding), new development via innovation proposals, reward for people who host the repositories and so on.

Treasury may also be used for buy and burn schemes to give project tokens a value boost. Buy and burn means that part of treasury is used to purchase tokens from decentralised exchanges and “burned” - moved to a special address making them inaccessible forever.

Buy and burn makes all token types liquid all the time. This is important for governance tokens as voting holders may decide to cash out their influence in the project if they loose interest and buy-and-burn means that these tokens will be permanently nulled.

Some amount might go for national taxes. This tax would be based on the location of the users, if it is known.

A small fraction from Treasury could be diverted to general support for the ecosystem (bugs bounties for generally used baseline technologies, further development, new tools, grants for new ideas…).

As mentioned steering the future of the project is handled with governance tokens ($GTOKEN). Voting is both for immediate improvements but also for changes in policies. Projects may decide to have more fundamental policies “constitution” and make those policies specifically hard to change and more day to day operational rules (like regular laws and decrees). Governance tokens are given to stakeholder – users, creators and people who run the infra). Granting is based on currently effective project policy. Token distribution is one of the topics that can be changed via the governance process itself.

Governance tokens are listed on exchanges allowing people to purchase them unless project specifically restricts this.

There are many ways to count votes and exact rules on this will be defined by the governance process. These have discussed before (token, person, quadratic, conviction, Sogur model where balanced by Gini)

Governance needs to be split into two parts:

Slow moving parts to cover the fundamental aspects of the project. This is like the “constitution” of the system. Topics on this level could for example be the governance process (voting etc.) and what metrics are measured from the system as basis for granting governance tokens. Constitutional changes need to have a much larger vote in favor before going through.

Operational parts like individual technical development ideas for the service or product portfolio offered or the average inflation level if new tokens are minted.

Digital designs create two-sided markets and kick-starting problem

Any network faces a two-sided market problem and token incentivization is no exception. Networks that are big attract users and users attract providers (contributors, sellers).

Initially any network is small and there is not that much content or service is limited.

Token driven designs however have a big upside. Today’s centralised platforms consolidate all value to the orchestrating company with people essentially contributing for free to it. Crypto networks work in a totally different approach. The value flows back to the users and content creators and its possible to set up the token distribution so that early joiners get a little bit larger share than late comers. This means that finding and joining successful services and platforms early is well rewarded and even late comers get a fair compensation of their work. The value proposition is superior compared to what centralised platforms offer today.

To get kick-started many other variants are being used:

Air drops. This means giving tokens to anyone who has participated in the service in early phases (in the words of Woody Allen – 80% of success is just showing up). Once people have tokens it becomes their interest to promote the network

Minting tokens continuously to participants even when their service/contribution does not have (yet) users or very minimal usage/value. In this option care must be taken to ensure are rewarded in proportion to the value their bring. Instead of tokens, a project may issue “points” with promise that these later convert to tokens as token design is from legal point complex and subject to risks.

Both kick starting models have problems. People expect airdrops and join projects just to collect them and leave immediately after cashing out. This results in the project token having some value early on and immediately crashing through the floor once airdrop is issued. This makes the project look like a failure and some kind of scam even when it is trying to create real value.

Same problem persists with continuous minting of tokens. As there is no feedback from real users, it may reward graciously early joiners who provided content of no value. With AI based tools, it’s easier than ever to create good looking garbage.

Also, shady practices are being practiced like airdropping to well-known figures in the industry and then implying that they purchased out of their own interest. There is no way to prevent someone sending tokens to your wallet if it is known. For recipient this type of unsolicited drops are a nuisance as just burning the tokens (by sending them to a special address that can only receive tokens) costs transaction fees.

In order to ensure that the token value stays at initial launch value or preferably has a tendency to go up in price, many projects implement models that effectively restrict the flow of tokens. Common mechanisms are ones where you “stake” i.e. lock up your tokens to a smart contract and then in return get “interest” or get a higher earning rate or some other benefit. These staking mechanisms ensure that very little tokens from users are being traded on exchanges and the rate that the token gets, will be dominated how the treasury buys up them. The end result is that the tokens seem to have increasing value but as there is very little supply, no one knows what the organic price would be. Until there is one of these crypto-winters and everyone wants to sell all of their different types of tokens at once.

Digital designs and deflation

In software as a rule of thumb, open sourcing reduces the monetisation (money extracted from customers) by about 90% compared to older, closed source businesses. But as the use expands widely, this can still be a good business for companies selling support. In fact, it has turned out the be the winning formula. In most domains OSS products are the ones that new projects will be using and cloud companies and software as a service products are typically more or less completely built on open software with a few exceptions.

When physical products also become digital “recipes”, this reduces the need for payment with equivalent rate and will create a strong deflationary pressure. Over time it can decimate the concept of gross national product, as most of value is not accounted for in monetary terms.

Deflation can cause economic instabilities. It makes sense to wait if one does not need something immediately as the price is likely to be smaller tomorrow. Demand goes to minimum. And this draws prices down forcing banks to ask more collateral that loaners do not have, causing forced sales. Supply goes up and demand down speeding up the cycle. Classical symptoms of depression.

Add to the mix the fact that production in fab labs can be automated or almost automated reducing need for human work. Same can happen in product design with machine learning models doing much of the mundane product creation work.

The system may end up in stability if the new production facilities are co-owned by members of the community or co-op. Since any production facility has limited capacity, the easiest approach would be to give each member same amount of free production capability and the possibility to purchase additional capacity. This would be a freemium model. The facility can reserve some extra capacity to be sold and use the income as a way to pay for maintenance and growth. In addition there needs to be a marketplace where members can trade capacity with each other (i.e., if I am travelling, I could sell up my share).

As the population is getting older and the population pyramid gets inverted, this might actually turn out to be a good thing as machines will do the work when there are not enough people in working age.

Physical services

Physical services are different because they take up initial investment that can be very large.

The initial sum may be gathered from volunteer investors, with an Inexhaustible Treasures fund or even inherited/granted from some centralised national organisation. This means that the initial creation is much more difficult and investors will spend quite some time vetting each case and calculating return of investment. In digital services the barriers of entry are much lower and people/teams much more willing to experiment.

For physical services it makes more sense to charge per usage – each litre of water used, kilowatt consumed, kilometre travelled on roads or fixed per usage fee for harbours and airports. This is same as the unit price in digital. Block pricing also makes sense (buy ten thousand kilometres for a year at price one, twenty for two and each additional thousand for some set amount).

The main change to previous model is the additional need for initial capital and operational expenses that needs to be set aside into own fund. This fund is used to pay for loan/investment costs, possible personnel costs and maintenance.

Another big difference is that self-owning infra should be capable of expand and reduce its footprint as the demand grows or shrinks (it should be noted that this is far from what is today and no one seems to be planning for it either). As infrastructure in future will be made from re-usable modules, these can be resold in case of scaling down and the income will flow back to the Treasury. (the modularity and pop-up infrastructure were discussed briefly in Infrastructure in a Box post with some examples)

Fiscal and monetary policies

The models above are real economies, albeit project scoped and hence small.

Economies can create fiscal policies. Fiscal policies in real economies means the tax rate and what government does with the funds. Here the “tax” is the cut of each transaction that goes to the treasury and what it is used to finance. Typically, maintenance, new development, expansion as seen fit.

There are also monetary policies. Monetary policy is what the central bank does. What is the interest rate and how new money is created? For web3 one option for monetary policy is to have an inflationary model where new tokens are continuously minted.

Again, this creates new funds for allocation via fiscal policies.

In decentralised economies the final say for fiscal and monetary policies is with governance token holders. That’s why so much attention was devoted to decision making across various posts in the past. What is unique for decentralised model, is that there is a constant flow of new projects each experimenting with different fiscal and monetary policies. Over time the best working ones emerge and become dominant. It’s quite possible, even likely, that different verticals will end up with different approaches. Underlying differences tend to create different technical solutions after all.

Public services

Let’s look at the financial flows for a set of common, public services.

The public effort may have its own token or use fiat currency or stable coins. For stake of brevity, lets call public side token as public utility token ($PUT) and explore one option. It needs to be said, this is purely speculational, no such system exists.

The $PUT has inbuilt inflation with set number of new tokens being minted every day resulting in say 5% yearly inflation. In addition, a value added tax is carried over transactions involving members of that jurisdiction. VAT is paid for each transaction using native project tokens. A percentage of collected VAT in project tokens is then used to buy $PUT. This makes $PUT liquid.

Public side may also set up a “Inexhaustible Treasures” Fund – i.e., a fund that invests interest back to it and only a small portion of interest goes to fund daily activities. For more

These funds go to the Treasury.

Participants vote on the use of Treasury funds on several level. On the highest level there is a decision how funds are divided between operating expenses and new developments. Next division is made between different verticals like technology development, health, education, defence …

Decisions for final allocation of funds is then done using one of the many possible models. As example, decisions could be divided so that some part of the “budget” is decided through a representational decision body and part of it is allocated by participants so that they can pool their tokens and fund individual projects (the citizen’s and enterprise’s automation budgets concepts).

The Treasury is then used to fund projects for new work and to pay for daily operating expenses.

Some designs and public service automations can come from the “sideline” by being crowdsourced. For example it may be allowed for anyone to start a project to automate part of the public side functionality. They could get it funded by selling tokens using say a bonding curve (bonding curves rewards early participants more). Once a “privately” funded project automates some aspect of public services, some percentage of realise savings would be paid as reward. The project can then divvy up the income as their policies define.

Bugs’ bounties are used to smoke out errors in any service implementation and teams finding errors rewarded from the Treasury.

Some public services will be free (like health diagnostics, digital education), some can be pay per use (fees per day spent at hospital for example), others based on subscription fee. This income goes into Treasury.

Algorithms like TechRank can be used to calculate compensation to digital contributors for code/content/analytics that is not rewarded in any other way.

Why would public side use a token rather than fiat currency? Cryptocurrencies provide transparency, the policies are set in code making it harder for politician to “raid” the central bank with schemes like quantitate easing. This gives stability and credibility to the token in addition to what fiat currencies have (fiats are ultimately backed by the violence machinery of the state and thus quite reliable but subject to politicians actions causing runaway inflation).

Cryptocurrencies are also global and would allow anyone from anywhere in the world to contribute to the automation of public services and the contributor can be assured of prompt payment as the code is automating this and even publicly auditable.

Using the same system as anyone else allows to take advantage of any existing services like decentralised exchanges and future innovations as the blockchain services are composable by nature.

Classification of goods and pricing

From the above discussion it seems that the way financial flows work and products and services get sold depends on the nature of the item.

This can be summarised in a table as follows:

Private Goods are best charge on pay-as-you-go basis. You pay for water per litre, electricity per kWh, materials by their natural unit (weight, volume, etc.). Same goes for services like barbers, restaurants and so on. And physical property like lots of land and buildings will most likely still be sold and bought using national currency.

Common Goods are free (picking mushrooms, nature etc.) but higher value get sometimes charged like fishing permits (e.g. per place or per month/season).

Clubs will have fees. NFTs are a form of club fees even when people do not usually view them that way (NFTs are digital ownership certificates for certain online assets, in this context usually digital images). Club being the community who launched and who have purchased the other NFTs. NFT “Club” membership gives some perks like bragging rights, access to events or community’s discord (digital hangout with chatting, video). If the club is exclusive and has a vibrant membership of high-profile members, the entry fee can be high.

Public goods like roads are paid by taxes but actually have indirect per distance charge – for example through gasoline tax. Taxes are also used to pay for harbours and airports (mostly, they can also be private goods and many smaller airports and harbours are). They have per use charges (harbour and airport payments/taxes per ticket). We predict they will become self-owning and charge per usage.

Network goods. Goods that gain value there more there are users but have a barrier in terms of payment. Digital content like music is today available both freely (with ads) or through monthly subscriptions. Ads make sense in future (as there is less products to sell when everything is available digitally for free or for pennies) so monthly subscription model seems inevitable. This would indicate digital designs will be available through a for charge discovery and streaming/download platforms that lift to top relevant results to each user.

For digital content, also the patron model will be used to some degree. Fans giving funds to artists in support of their work as a form of appreciation. This gives the artists freedom to create as to their liking unaffected by external influences like marketing.

Symbiotic goods is the natural habitat of all things digital. We predict that over time everything that can be digitalised, will be. This includes almost all product categories. Four options are: open source, subscription model (network good), care services or freemium. Open source/design would mean that the results are free but team gain livelihood by selling care. Care includes emergency error corrections, personalisation, adaptations, trainings etc. Freemium is a mix where you get some quote for free but some functionality is restricted to paying customers. Whether the digital domain will settle as network good or symbiotic good, remains to be seen.